The current VAT threshold is £85,000. If you’re turnover is likely to exceed this during a rolling 12-month cycle (not necessarily the financial year) then you should register for VAT – even if you sell products and services that would not normally attract VAT. VAT is a tax which is added to your sales, based on a percentage of the product.. The current VAT threshold is set at £85,000 and is confirmed until March 2024. The threshold is strictly associated with turnover, not profits – so you can’t use tax reliefs or capital allowances to avoid becoming eligible for the VAT scheme. The VAT threshold used to rise each year until 2017, when it reached the £85,000 threshold it.

What is the annual turnover threshold limit for GST registration?

VAT Threshold Tax Taccount

Pros And Cons Of Being Vat Registered

Expert Advice on How to Reduce Employee Turnover Motorlease Fleet Management & Leasing Solutions

(PDF) China’s turnover taxation in the preVAT period 194993

Extension of Making Tax Digital for VAT AccountsPlus Accountants

The concept of the turnover threshold. Download Scientific Diagram

Audit VAT turnover reconciliation YouTube

VAT Registration What Is It and Why You Need To Legend Financial

VAT deduction can be denied because the company has not reached a certain turnover threshold set

GST Council to meet soon may fix Rs 50 cr turnover threshold for einvoice under GST

Absenteeism & Turnover Media Logistics Namibia

Company eligibility threshold concept icon. Business eligibility criteria abstract idea thin

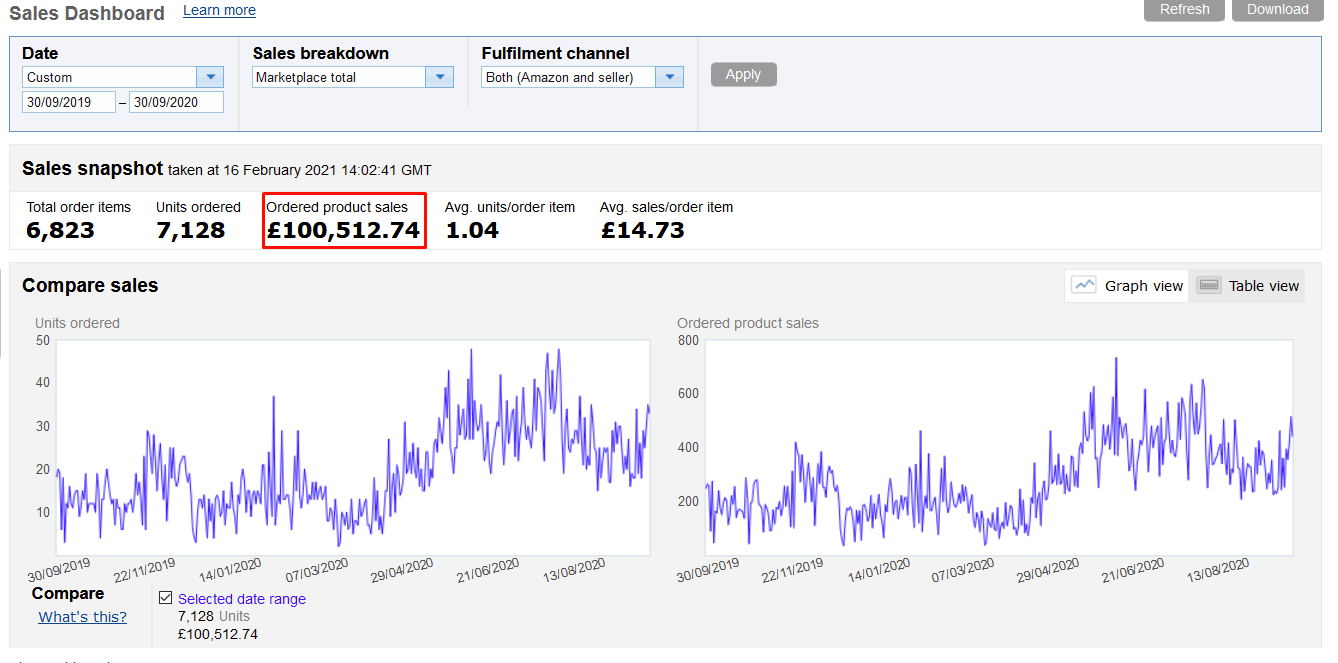

What determins turnover VAT Threshold query General Selling on Amazon Questions Amazon

Why do businesses register for VAT when their turnover doesn’t exceed the registration threshold

What is the VAT Registration Threshold? The Accountancy Partnership

How To Stay Under The VAT Threshold Checkatrade

New GST Exemption Threshold Turnover Limit in 2019

How to Avoid High Turnover Rates at Your Company Idaho Business Journal

Does Your Turnover Exceed the VAT Threshold? Your Business Must Be Ready for Making Tax Digital

Home » » The Journal » How to Avoid Being Registered for VAT. The current threshold for compulsory VAT registration is taxable turnover of £85,000 in the last 12 months. This is a rolling measurement – if you look at the year to 30 June and you are under, that’s fine. However, you then need to review for the year to 31 July, and so on.. A business cannot have some activities registered and some not. Similarly, the VAT threshold (2017-18 £85,000) cannot be avoided by artificially splitting a business into separate parts and arguing each part is under the threshold. However it can be possible for two people to own several businesses and treat each one separately for VAT purposes.