IR-2024-112, April 17, 2024. WASHINGTON – The IRS encourages taxpayers to use the IRS Tax Withholding Estimator to ensure they’re withholding the correct amount of tax from their pay in 2024.. This digital tool provides workers, self-employed individuals and retirees with wage income a user-friendly resource to effectively adjust the amount of income tax withheld from their wages.. FICA is a two-part tax. Both employees and employers pay 1.45% for Medicare and 6.2% for Social Security. The latter has a wage base limit of $168,600, which means that after employees earn that much, the tax is no longer deducted from their earnings for the rest of the year. Those with high income may also be subject to Additional Medicare tax.

How Much Tax Will I Pay On 50000 Uk Tax Walls

CARPE DIEM Real AfterTax Profits Reach New Record High in Q4

Solved Taxes paid for a given level Jacques is

![100k AfterTax By State [2023] Zippia](https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png)

100k AfterTax By State [2023] Zippia

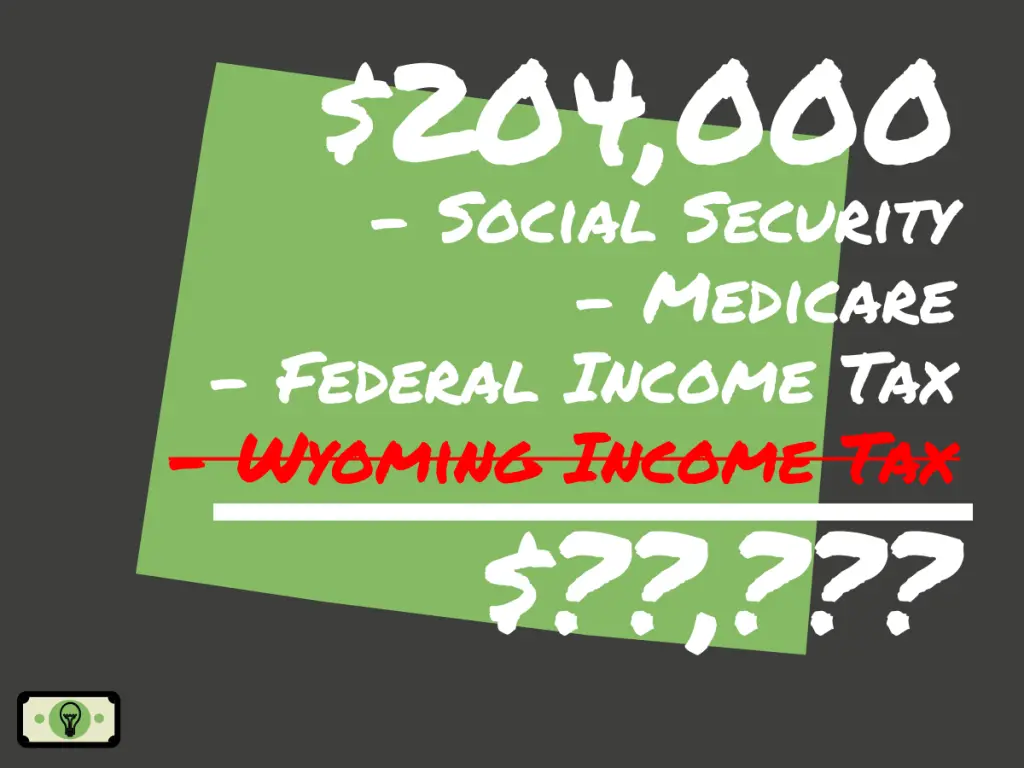

204,000 Salary After Taxes in Wyoming (single) [2023]? Smart Personal Finance

215K Dollars Salary After Taxes in Nevada (single) [2023]? Smart Personal Finance

Life of Tax How Much Tax is Paid Over a Lifetime Self.

LMAO before and after taxes roll in. =) Tax season, Accounting humor, tax humor

In 1 Chart, How Much the Rich Pay in Taxes 19FortyFive

Do I have to pay taxes on my workers’ compensation check? Law Office of Darren Shoen

40 increase in pay, 7k after taxes, looks good but currently I’m only posting memes since there

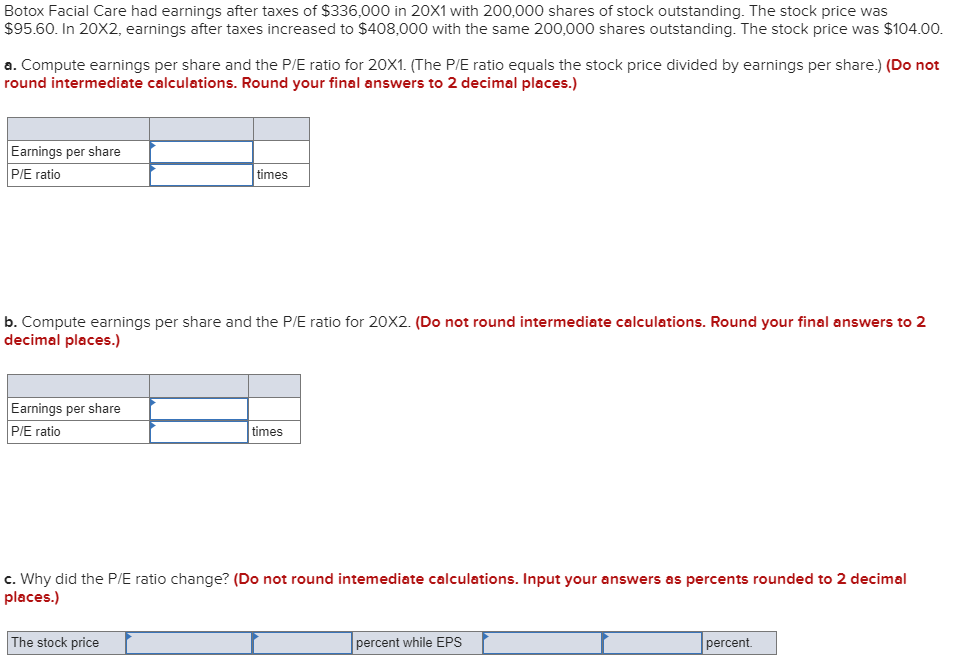

Solved Botox Facial Care had earnings after taxes of

3 Effective Tax Strategies for Investors — Chatterton & Associates

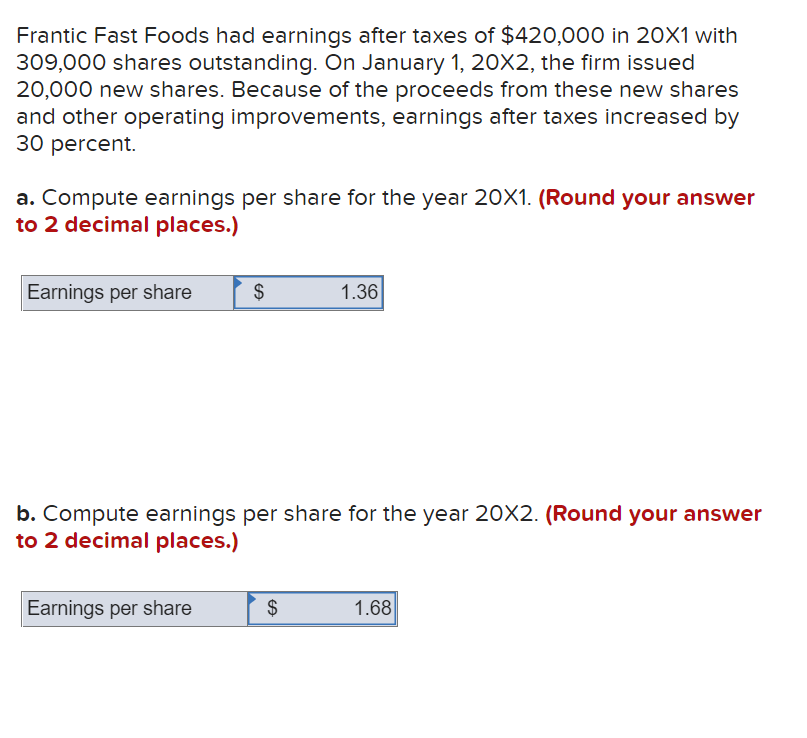

Solved Frantic Fast Foods had earnings after taxes of

Do It Yourself Taxes Online 9 Worst Home Improvement Projects That Decrease Resale Value

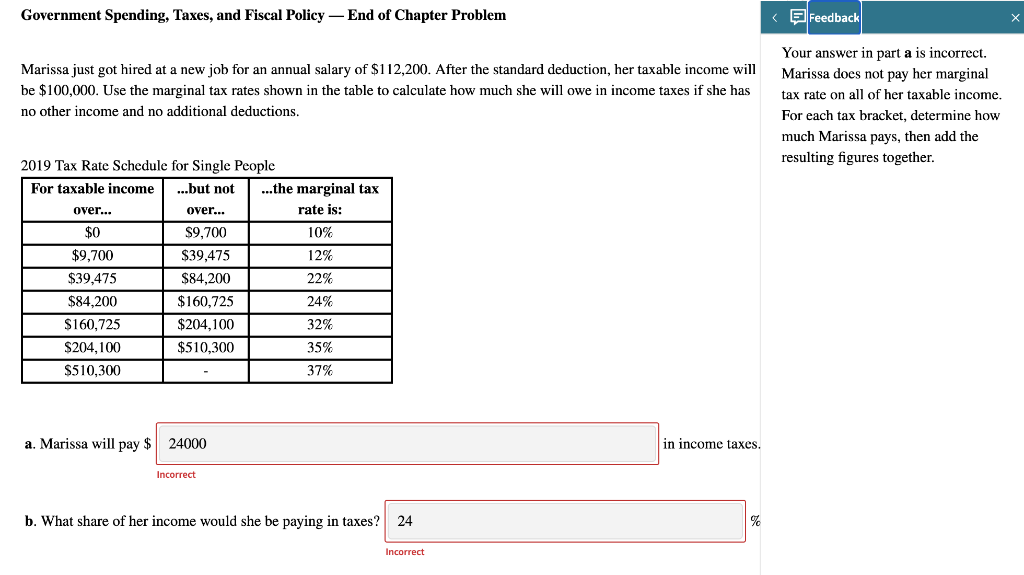

Solved Government Spending, Taxes, and Fiscal Policy End

after doing my own taxes

States With High Taxes Face Grim Future in Tax Policy Revolution

Establishment of After Tax Cash Flow Example YouTube

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net After Taxes (NIAT) Definition, Calculation, Example

144.70. 18.09. 81.79%. Tip: Social Security and Medicare are collectively known as FICA (Federal Insurance Contributions Act). Based on this calculation your FICA payments for 2024 are $3,519.00. The California income tax calculator is designed to provide a salary example with salary deductions made in California.. To calculate this you need to know how many hours per year you work, then just divide $45,000 by that number. That means, if you work the standard 40 hour work week, 52 weeks per year, you’d need to divide $45,000 by 2,080 hours (40 * 52). If this is your measure, $45,000 per year is $21.63 an hour. However, if you freelance, side hustle or.