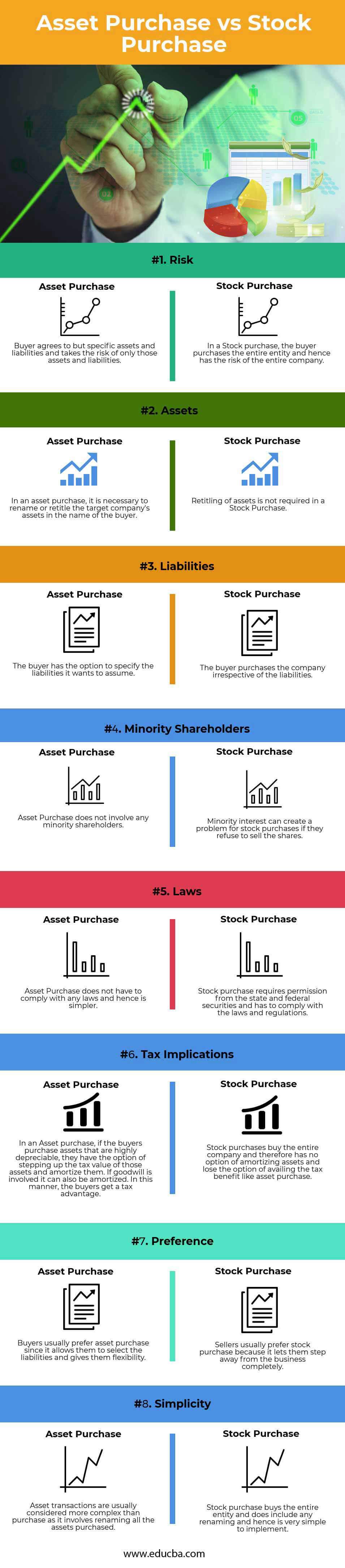

Where sale proceeds are needed personally by the selling shareholders, a share sale generally results in favorable capital gains treatment to a seller whereby only one-half of the gain will be taxable as compared to an asset sale, which may have a higher tax cost upon distribution of the sale proceeds to individual shareholders.. Tax considerations for the purchase or sale of a business. At the time of sale, 90% or more of the fair market value of the corporation’s assets must be used principally in an active business carried on primarily in Canada (either by the corporation or by a related corporation), be shares or debt in a connected small business corporation, or be.

Buying or Selling a Business Asset vs. Share Sale

Share on sale dasebucks

Buying or Selling A Business Asset Sale v Share Sale OpenLegal

Asset Sales vs. Share Sales for Selling Your Business Sell your business, Selling a business

Asset Sale vs. Equity Sale Key Considerations When Selling Your Business Jimerson Birr

Asset Sale vs Share Sale Does Selling Assets Get A Better Price Than Selling Shares

Asset Sale vs Share Sale Which one is right for you? Nextoria

Why you need a Buy Sell Agreement in place Long Saad Woodbridge Lawyers

Differences Between a Share Sale & an Asset Sales Palumbo Law

Asset Sale and Stock Sale Definitions, Differences, and Advantages BUY THEN BUILD

Share sale vs asset sale YouTube

Asset Sale vs. Share Sale What Business Owners Should Know Jack Talks Business

Asset Sale vs. Stock Sale What’s The Difference?

4 Differences Between Asset Sale vs. Stock Sale

Asset Sale vs Share Sale Selling Your Amazon Business

Asset Sale Vs Share Sale Which One to Choose when YOU Sell Your Clinic

Asset Purchase vs Stock Purchase Top 8 Best Differences To Learn

4 Differences Between Asset Sale vs. Stock Sale

Asset Sale vs. Share Sale Business Law Kalfa Law Firm

Asset Sale vs Stock Sale Tax Consequences (What You Need To Know)

The sale price may be reduced for a share sale (vs asset sale) if the seller is eligible for lifetime capital gains exemption due to the tax savings for the seller.. Canadian Sales Tax Rates for 2023 January 30, 2023 Question: What are the sales tax rates across Canada in 2023? Facts: The table below outlines. Read More » January 30, 2023.. The ability to selectively choose is the main reason that buyers prefer to structure a transaction as an asset purchase instead of a share purchase. In an asset sale, the seller’s corporation remains with the seller. An asset purchase is more complex than a share purchase because each asset must be transferred using separate documentation.